# How Liquidity Pools Work for BNB Chain Meme Coins

[](https://postimg.cc/0zshnr7T)

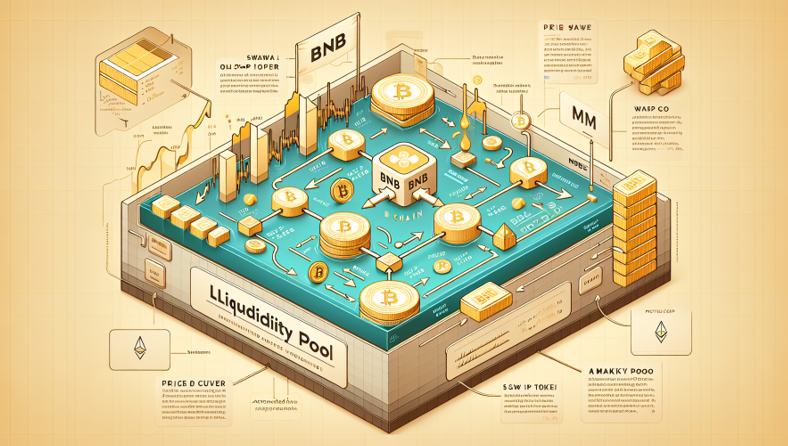

<p>Liquidity pools are a fundamental component of decentralized finance (DeFi), playing a critical role in enabling trading, especially for niche markets like meme coins on the BNB Chain. As platforms like <strong><a href="https://bnbpump.fun">pump.fun for BNB</a></strong> continue to innovate in this space, understanding how liquidity pools function becomes essential for both creators and investors. This article will delve into the mechanics of liquidity pools, focusing on their role within the BNB Chain ecosystem.</p>

<p> </p>

<h2><strong>Understanding Liquidity Pools</strong></h2>

<p> </p>

<p>Liquidity pools are collections of tokens locked in a smart contract to facilitate trading by providing liquidity. They are crucial to automated market makers (AMMs), which are decentralized exchanges (DEXs) that utilize these pools instead of traditional order books. This mechanism allows for trading without needing a direct counterparty, significantly enhancing the efficiency and accessibility of trading on platforms like Binance pump.fun.</p>

<p> </p>

<h3><strong>How Liquidity Pools Work</strong></h3>

<p> </p>

<p>At their core, liquidity pools rely on the principle of token pairs, which are two different tokens that can be traded against each other. For instance, a popular pair might be a meme coin and BNB. When users provide tokens to a pool, they enable others to trade these pairs by maintaining a balance determined by a bonding curve. This curve, a defining feature in DeFi, ensures that token prices adjust according to supply and demand.</p>

<p> </p>

<p><strong>#### The Role of Liquidity Providers</strong></p>

<p><strong> </strong></p>

<p>Liquidity providers (LPs) are individuals or entities that deposit equal values of two tokens into a pool. In return, they receive liquidity provider tokens, which represent their share of the pool and can be redeemed for the underlying assets. LPs earn fees from trades conducted within the pool, making it an attractive passive income opportunity. However, they also face risks such as impermanent loss, which occurs when the price ratio of the deposited tokens changes unfavorably.</p>

<p> </p>

<h2><strong>Advantages of Liquidity Pools on BNB Chain</strong></h2>

<p> </p>

<p>The BNB Chain offers several advantages for liquidity pool operations, particularly for meme coins:</p>

<p> </p>

<ul>

<li><strong>Low Transaction Fees</strong>: Compared to other blockchain platforms, BNB Chain's transaction fees are relatively low, making it economically viable for frequent trading and liquidity provision.</li>

<li><strong>High Throughput</strong>: With its robust infrastructure, the BNB Chain supports a high number of transactions per second, which is crucial for the fast-paced nature of meme coin trading.</li>

<li><strong>Integration with BNB Pump.fun</strong>: Platforms like pump.fun BNB Chain provide seamless integration for creating and trading meme coins, leveraging the liquidity pool model to enhance user experience.</li>

</ul>

<p> </p>

<h2><strong>Criticisms and Challenges</strong></h2>

<p> </p>

<p>Despite their benefits, liquidity pools are not without challenges. A common criticism is the risk of impermanent loss, which can deter potential liquidity providers. Additionally, not all platforms offer the same level of security and user experience. For example, some competitors may lack the intuitive interface and fair-launch mechanics found on pump.fun for BNB, which are crucial for attracting and retaining users in the meme coin market.</p>

<p> </p>

<h3><strong>Security and Smart Contract Risks</strong></h3>

<p> </p>

<p>Security remains a significant concern. Liquidity pools are governed by smart contracts, which, if poorly audited, can be vulnerable to exploits. Reputable platforms typically undergo rigorous security audits to mitigate these risks. Users should look for platforms with proven security records to ensure the safety of their investments.</p>

<p> </p>

<h2><strong>Conclusion</strong></h2>

<p> </p>

<p>Liquidity pools are a vital component of the DeFi landscape, especially for trading meme coins on the BNB Chain. They offer a decentralized, efficient method for exchanging tokens, benefiting both traders and liquidity providers. As platforms like BNB Pump.fun continue to evolve, they provide innovative solutions that enhance the liquidity and trading experience for meme coins. While challenges such as impermanent loss and security risks exist, the potential rewards and developments in this space make it a compelling area for exploration. For those interested in diving deeper into the world of meme coins and liquidity pools, platforms like <strong><a href="https://bnbpump.fun">pump.fun for BNB</a></strong> offer a promising starting point.</p>